LUM Research – Assistance Programs

Summary

Lafayette Urban Ministry has a longstanding Financial Assistance Program aimed at supporting low-income residents of Tippecanoe County, Indiana, who are within 185% of the federal poverty line. The program assesses client needs and provides payments to relevant third parties, such as rental agencies and utility companies, for legitimate needs. To enhance the program’s effectiveness, LUM conducted a survey to gain insights into its clients and potential improvements. The most prevalent reason for seeking assistance was overdue rent payments. Other key findings are as follows:

- Client Demographics & Employment: 50% had job loss or reduced hours; 40% were employed without enough income to meet basic living needs; 20% had full-time jobs and 20% had part-time employment; The remainder (10%) were unemployed, in temp work or day labor. LUM is seeing an increasing number of ALICE families (Asset Limited, Income Constrained, Employed).

- Educational Attainment: Overall lower than the average county resident; 13% had less than a high school diploma (compared to 7.4% county average); 50% had a high school diploma (26.9% county average); 27% had some college or an associate’s degree (25.1% county average); 7% had a bachelor’s degree (40.6% county average).

- Frequency of Assistance: Average, three times; and clients seeking rental assistance were more likely to use the program more frequently, indicating the challenge of high and unsustainable rent costs.

- Unbanked Clients: Surprisingly, 47% of clients did not have a bank account, significantly higher than the national average of 4.5%. Reasons for being unbanked included inability to meet minimum balance requirements, distrust of the banking system, high/unpredictable fees, and past credit problems.

- Interest in Financial Education: 70% expressed interest; and LUM plans to delve deeper into this interest and consider piloting a financial education program to empower clients toward greater financial stability.

In conclusion, the LUM Financial Assistance Program serves a vital role in assisting low-income residents facing economic challenges, especially related to housing costs and employment instability. The findings highlight the need for affordable housing solutions, potential efforts to promote banking access, and the potential value of financial education to support clients in building a more secure financial future.

This research was designed and analyzed by Dr. Cleve Shields, professor emeritus of Human Development & Family Science at Purdue University, West Lafayette, IN. To read more about this research project, read below.

Detailed Report

The Lafayette Urban Ministry Financial Assistance Program has existed in various forms since the inception of LUM. The target audience for this program is low-income Tippecanoe County residents living within 185% of the poverty line. Program staff and volunteers assess client needs, and if those needs are legitimate they pay the relevant third party (e.g., rental agency, electric company, etc.).

LUM recently conducted a survey to get more insight into our Financial Assistance Program clients and what, if anything, LUM might do to better assist them in the future. Here are some of the main takeaways.

Half of the Financial Assistance Program clients came to us either because they’d lost a job or had a reduction in work hours. Forty percent were ALICE households (Asset Limited, Income Constrained, Employed). Only 20% of the clients had a stable full-time job. Another 20% had stable part-time work. The rest were either unemployed or engaged in gig work, temp work, or day labor.

When compared to the average Tippecanoe County resident, Financial Assistance Program clients were far more likely to have either a high school diploma or to have not finished high school, and far less likely to have a Bachelor’s degree.

| Education Level | Financial Assistance Program Clients | Tippecanoe County |

|---|---|---|

| Less than High School | 13% | 7.4% |

| High School | 50% | 26.9% |

| Some College/Associates Degree | 27% | 25.1% |

| Bachelor’s Degree | 7% | 40.6% |

The most common reason clients came to the Financial Assistance Program was that they were behind on their rent. This shouldn’t come as a surprise, since rents in Indiana have gone up 28% since 2019, and 27% of renters in Tippecanoe County now pay more than half of their income towards rent.

The average client has only used the Financial Assistance Program three times over the years. However, clients who came to LUM for rental assistance (as opposed to utilities or prescription medications) were twice as likely to have used the program from 3 to 6 times, and five times as likely to have used it 7 or more times. The upshot is that rents are unsustainably high for many of our clients, and there is a desperate need for more affordable rental housing in the county.

One of the most interesting takeaways was that 47% of Financial Assistance Program clients did NOT have a bank account. This is far higher than the national average of 4.5%. Some of the most common reasons people in the US might be unbanked are:

- They don’t have enough money to meet minimum balance requirements

- They don’t trust the banking system/want to protect their privacy

- Bank Fees are too high/unpredictable – particularly overdraft fees

- Past credit problems have made them too high of a risk

LUM is planning to hold a focus group with some of our clients to determine why they are unbanked, and what LUM can do to change that.

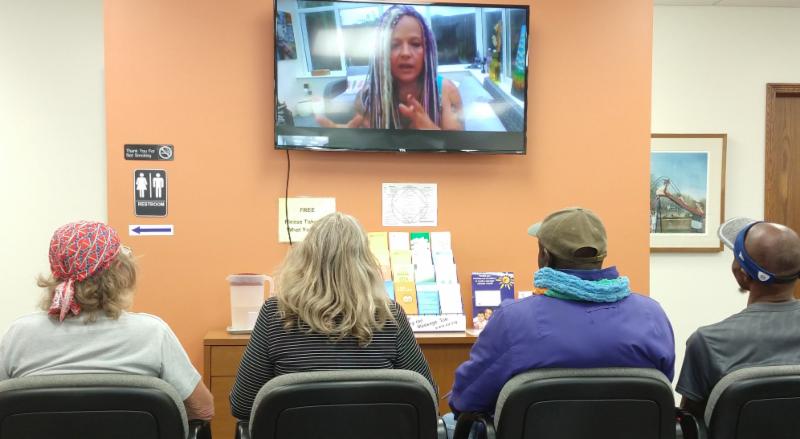

The final takeaway was that 70% of Financial Assistance Program clients said they could benefit from financial education. LUM will use our planned focus group to explore this further and decide whether or not to pilot a financial education program for our clients. Such a program could potentially provide a solid foundation for them to work towards a more stable financial future.

This data will help shape and improve LUM assistance program especially the LUM Financial Assistance Program. This is one recent example of how LUM is using data to improve lives.

How LUM Uses Data to Improve Lives

As an organization committed to making a meaningful impact in the lives of individuals and our community, LUM has recognized the pivotal role that research plays in driving positive change. LUM firmly believes that evidence-based strategies and data-driven decision-making are essential to creating lasting improvements. Through our dedication to research, we are continuously evolving and refining the programs, ensuring that LUM makes a genuine difference in the lives of those we serve. Here are a few examples of research projects within LUM programs:

- LITERACY – LUM 5th Quarter Summer Learning Program

- EMPATHY – LUM Financial Assistance Program

- MENTORING – LUM After School Program

- HOPE – LUM Emergency Shelter

At Lafayette Urban Ministry, we firmly believe that research is not just a means to an end but an integral part of our journey towards lasting change. It fuels our passion, drives our decisions, and shapes our impact. LUM strives to ensure that every effort we make is purposeful, effective, and capable of creating a ripple effect of positive change. As we move forward, our dedication to research will remain unwavering, empowering us to transform lives and build a brighter future for our entire community.